Biden Justice Department Makes An Example Out Of IRS Whistleblower

President Joe Biden's campaign seized on IRS whistleblower Charles Littlejohn's revelations about Trump's tax returns. Instead of honoring Littlejohn, the Justice Department sought one of the harshest prison sentences ever.

The following article was made possible by paid subscribers of The Dissenter. Become a subscriber and support independent journalism on whistleblowing and freedom of the press.

In September 2020, after the New York Times published a report on President Donald Trump’s tax returns, Democratic presidential nominee Joe Biden and his campaign seized on the information disclosed by an IRS whistleblower.

CNN reported that Biden’s campaign “reacted swiftly” to the revelation that “Trump paid no federal income taxes in 10 out of 15 years beginning in 2000, turning around a digital video and putting out merchandise within hours of the report’s release.”

Biden’s campaign tweeted out the average amount of income taxes paid by teachers, firefighters, and nurses, which was much higher than what Trump paid annually. Campaign stickers were produced that said, “I paid more income taxes than Donald Trump.”

Given how Biden and his presidential campaign responded, one might think that Biden would have celebrated Charles Littlejohn, the IRS contractor who shared Trump’s tax returns. However, on September 29, 2023, the Justice Department (DOJ) charged Littlejohn with one count of “unauthorized disclosure of tax returns and return information.”

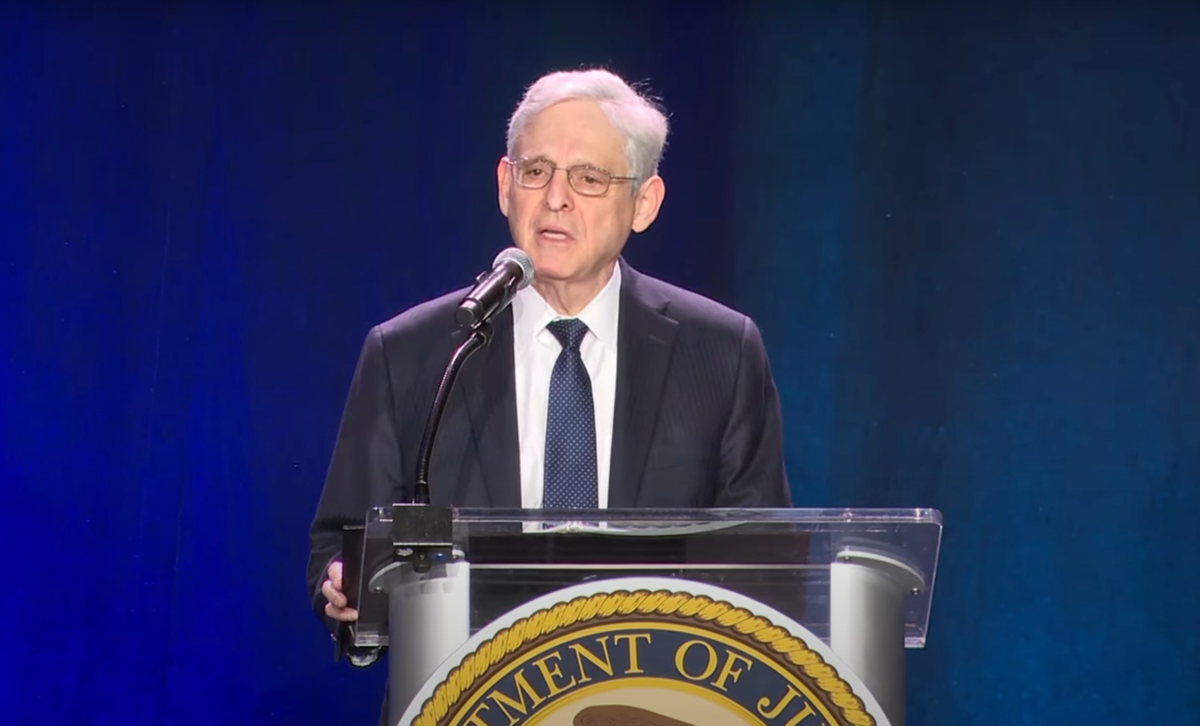

Littlejohn took responsibility for his actions in October and pled guilty. Attorney General Merrick Garland put his stamp of approval on the outcome. “By using his role as a government contractor to gain access to private tax information, steal that information, and disclose it publicly, Charles Littlejohn broke federal law and betrayed the public’s trust.”

Yet a guilty plea was not enough for federal prosecutors. In January, the DOJ urged the United States District Court for the District of Columbia to sentence Littlejohn to five years in prison—the maximum possible sentence.

The government’s sentencing memo [PDF] contended that an unprecedented prison sentence was necessary to “send a message to other individuals like [Littlejohn], who have been entrusted with Americans’ private taxpayer information.”

Remarkably, the government suggested that Littlejohn, “motivated by ideology or politics or economic gain,” may have disclosed Trump’s tax returns because he was confident that he would only receive a short prison sentence if caught. The court was asked to issue a “lengthy term of incarceration” so that future whistleblowers would think twice about exposing similar IRS information.

On January 29, the court sided with the government and issued one of the harshest prison sentences ever for an unauthorized disclosure of tax information to the press.

'Morally Wrong' For Trump To 'Withhold Information'

Littlejohn did not only disclose Trump’s tax returns. He also provided files to ProPublica that the public interest journalism outfit described as showing “how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth—sometimes, even nothing.”

The sentencing memo [PDF] submitted by Littlejohn’s defense indicates that the IRS contractor was motivated to release the “tax records of ultra-high net worth taxpayers with relatively small tax payments” after reading “The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay” by Emmanuel Saez and Gabriel Zucman.

In Littlejohn’s mind, none of the proposed solutions to addressing systemic inequality would be possible unless there was “robust public engagement.” To catalyze interest in the issue, he concluded that an “investigative report” on tax dodging by the super-rich.

As far as Trump’s tax returns, after Trump refused to release them in 2017, Littlejohn “believed it was morally wrong for the administration to withhold information that had always been shared with the American people,” according to the defense sentencing memo.

Littlejohn had several in-person meetings with Times reporters between May 2019 and August 2019, where he determined that the media organization “shared his belief that the American public had a right to know the President’s tax information and would responsibly report on the records he provided.” He was assured that the newspaper would “securely maintain the data, avoid publishing the records themselves, and “use the information solely for journalistic purposes.”

Beginning in August 2019, the defense sentencing memo said Littlejohn took copies of Trump’s tax returns and spent the next year helping the Times analyze the data. He later shared additional tax records to help the media organization further contextualize what he initially provided to the newspaper.

The first article was published by the Times on September 27, 2020, and Biden’s presidential campaign immediately recognized that the reporting could help them present Biden as the candidate most capable of representing working people.

“You have in Donald Trump a president who spends his time thinking about how he can work his way out of paying taxes, of meeting the obligation that every other working person in this country meets every year,” Biden campaign manager Kate Bedingfield told CNN. “You know, with Joe Biden you have somebody who has a completely different perspective on what it means to be a working family in this country.”

Punishing Littlejohn As If He Faced An Espionage Act Offense

At sentencing, prosecutors disregarded the way in which Biden embraced revelations from the Times, which came from Littlejohn, and argued that the punishment in similar cases had “inadequately accounted for the seriousness of ideologically motivated leaks.”

“In one recent case, an IRS analyst [John Fry] accused of leaking Suspicious Activity Reports (SARs) associated with a prominent attorney [Michael Cohen] received a probationary sentence,” the government noted. “In another, an employee of the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) [Natalie Edwards] was sentenced to six months in prison for leaking thousands of SARs and other materials containing sensitive personal and financial information to a reporter purportedly because she believed that FinCEN engaged in wrongdoing.”

“Although tax returns and return information enjoy stronger statutory and privacy protection than SARs, the advisory sentencing guidelines applicable here still do not adequately capture the severity of offenses like this one,” the government concluded.

The overzealousness of prosecutors did not end there. Prosecutors additionally recommended that the court look to Espionage Act prosecutions against leaks of information related to U.S. national security or military affairs.

From the government’s sentencing memo: “The court may also look to similar cases involving the disclosure of classified information to journalists. For example, in one recent case, an employee of the Defense Intelligence Agency [Henry Frese] was sentenced to 30 months in prison after pleading guilty to communicating Top Secret/Sensitive Compartmented Information, primarily over the telephone, to two reporters.”

Prosecutors invoked NSA whistleblower Reality Winner’s case. When Winner was sentenced to five years in prison in 2018, Bobby Christine, the United States Attorney for the Southern District of Georgia, boasted about the fact that Winner had received the “longest received by a defendant for an unauthorized disclosure of national defense information to the media.”

Littlejohn’s defense maintained that a sentence of 12 to 18 months would be appropriate given sentencing guidelines. However, Judge Ana Reyes, who was appointed by Biden, fully embraced the aggressiveness of prosecutors.

“When you target the sitting president of the United States, you’re targeting the office and when you’re targeting the office of the president of the United States, you’re targeting democracy—you’re targeting our constitutional system of government,” Reyes proclaimed.

CNN reported that Reyes was frustrated that Littlejohn did not face more criminal charges. “The fact that he did what he did and he’s facing one felony count, I have no words for.”

'A Threat To Our Democracy'

Astoundingly, according to CNN, the judge compared Littlejohn’s nonviolent whistleblowing to the January 6th riots on Capitol Hill. “Your actions were also a threat to our democracy,” and, “It engenders the same fear that January 6 does.”

Reyes also said, according to Politico, “It cannot be open season on our elected officials—it just can’t.” And, “There was nothing noble or moral about the nature of his offense.”

“It did not produce a single social good that could not have been—has not been produced in some way by lawful means,” Reyes insisted, pointing to House Democrats who released Trump’s tax returns in 2022 “after a long legal fight.”

However, in 2020, Democratic Representative Bill Pascrell, who was chair of the House Ways and Means Subcommittee on Oversight and helped lead the “fight” for Trump’s tax returns, welcomed the disclosures.

"This blockbuster report confirms some of our worst fears. Donald Trump has spent his entire life abusing the tax system to lie, cheat, and steal on a scale that is almost unimaginable,” Pascrell declared. “The partial findings reveal absolutely staggering theft by Trump before and while he has been in office.”

Trump and the staff of his presidential administration engaged in secrecy abuses and obstructed the release of information, which the public deserved to know. Such actions shielded Trump from facing accountability until the end of 2022, when Trump was no longer in the White House.

Littlejohn had the courage to stand up to the fraud that was being perpetrated by Trump, and Biden embraced what Littlejohn revealed to help him win his election. But instead of honoring Littlejohn, the Biden Justice Department seized on the case to make it easier for federal prosecutors to secure harsher punishment against future whistleblowers and sources, who disclose information that is in the public interest to the press.

Comments ()